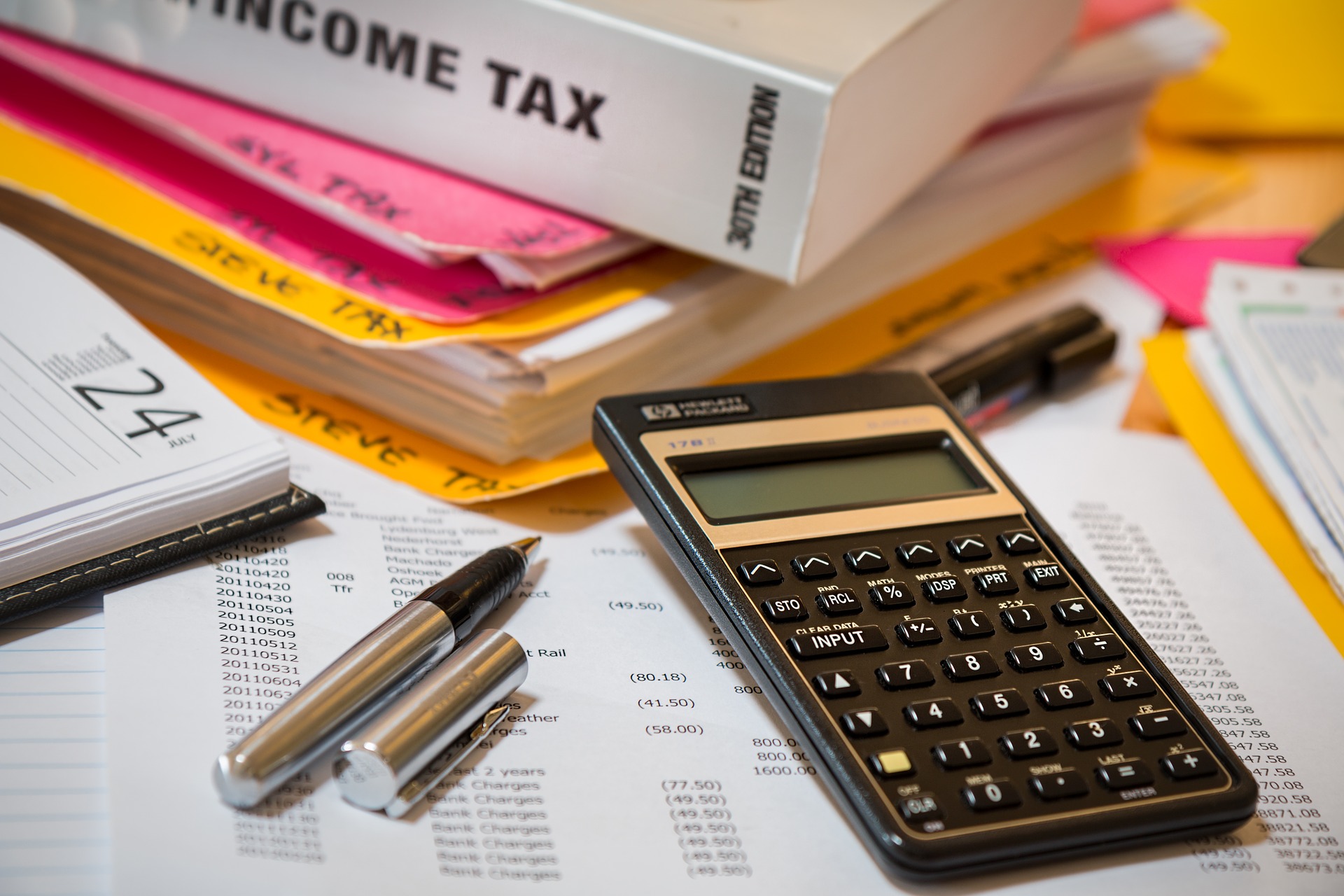

The corporate tax return is your opportunity to take a look at how much money you made and what percentage of it the government took. It’s also your chance to see if you owe any back taxes and pay them without penalties.

Here are 3 keys for successfully filing a corporate tax return:

- File on time – There is an April 15th deadline that all companies must meet or risk paying penalties.

- Keep good records – The IRS will need information from you in order to figure out what percentage of your revenue should be taxed, so keep accurate records!

- Make sense of it – Once you file, make sure that everything makes sense before submitting! If not, contact the IRS directly for clarification.

What are corporate tax returns?

A corporate tax return is when a company files their yearly revenue with the Internal Revenue Service (IRS) and calculates how much of that money they owe in taxes.

- This can be done by either creating an S Corp or C Corp.

How do I file on time?

As of April 15th approaches, you will want to make sure all your information is in order and easy for the IRS to understand. That means getting rid of any errors and making sense out of everything! If it doesn’t add up, contact them directly before filing.

To ensure accuracy:

- Make copies – Keep one copy at home and another in a secure location for backup just incase something happens to your original documents

- Use good math

- Double check everything

- Get it done as soon as possible to avoid the rush at the last minute!

Don’t forget about filing extensions. If you can not make your deadline, ask for an extension and start preparing early next year. Keep in mind that this should be requested well before April 15th or else you will get fined by late fees or possibly even interest on what is owed. And remember, if you are paying someone to do these taxes for you (i.e., a CPA), they need time too! So don’t wait until the last minute to file – give them ample time beforehand so there aren’t any mistakes or missed deadlines either!

Lastly, keep track of all financial records throughout the year. It is much easier to keep track of these documents when you have been doing it all year long rather than trying to find them in a frantic last-minute search!